Source: Federal Reserve Bank of New York

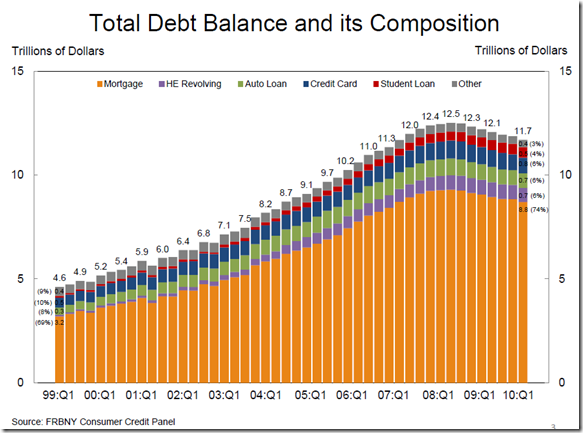

Aggregate consumer debt continued to decline in the second quarter, continuing its trend of the previous six quarters. As of June 30, 2010, total consumer indebtedness was $11.7 trillion, a reduction of $812 billion (6.5%) from its peak level at the close of 2008Q3, and $178 billion (1.5%) below its March 31, 2010 level.

The number of open credit accounts continued to decline, although at a somewhat slower rate, during the quarter. About 272 million credit accounts were closed during the four quarters that ended June 30, while 161 million accounts were opened. The number of credit account inquiries within six months – an indicator of consumer credit demand –ticked up for the first time since 2007Q3. Credit cards have been the primary source of the reductions in accounts over the past two years, and during 2010Q2 the number of open credit card accounts fell from 385 to 381 million. Still, the number of open credit card accounts on June 30 was down 23.2% from their 2008Q2 peak.

Household mortgage indebtedness has declined 6.4%, and home equity lines of credit (HELOCs) have fallen 4.4% since their respective peaks in 2008Q3 and 2009Q1. Excluding mortgage and HELOC balances, consumer indebtedness fell 1.5% in the quarter and, after having fallen for six consecutive quarters, stands at $2.31 trillion, 8.4% below its 2008Q4 peak.

For the first time since early 2006, total household delinquency rates declined in 2010Q2. As of June 30, 11.4% of outstanding debt was in some stage of delinquency, compared to 11.9% on March 31, and 11.2% a year ago. Currently about $1.3 trillion of consumer debt is delinquent and $986 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Delinquent balances are now down 2.9% from a year ago, but serious delinquencies are up 3.1%.

About 496,000 individuals had a foreclosure notation added to their credit reports between March 31 and June 30, an 8.7% increase from the 2010Q1 level of new foreclosures. New bankruptcies noted on credit reports rose over 34% during the quarter, from 463,000 to 621,000. While we usually see jumps in the bankruptcy rate between the first and second quarter of each year, the current increase is higher than in the past few years, when it was around 20%.

No comments:

Post a Comment