Sunday, November 30, 2008

Need to Learn About Securitization?

Explosion in the Monetary Base Signals Future Inflation

The monetary base is equal to reserves at financial institutions plus cash in circulation. When these reserves are loaned out the money supply expands. Recent actions by the Fed to ease credit conditions have created a massive increase in reserves. Should an expansion occur these reserves, if they are not constrained, can result in a significant increase in the money supply and inflation. The relation between reserves and the money supply is indicated by the money multiplier which is basically equal to the money supply (demand deposits plus cash in circulation) divided by the monetary base. The decline in the money multiplier has offset the increase in the monetary base. These series indicate that the liquidity needed to expand loans exists, but that the loans have not been extended.

Monetary policy is often compared to a string. The Fed can pull it (tighten credit markets), but cannot push on it (expand credit markets). It can make the funds available but it cannot force institutions to lend or borrow.

Friday, November 28, 2008

New Homes Sold Continues Decline While FHA Financing Increases

Wednesday, November 26, 2008

Decline Continues in Housing Price

Gay Married Couples Entitled to Insurance Benefits in New York State

"We expect insurance companies to provide the same rights and benefits to all legally married couples, regardless of the sex of the spouses," Dinallo said in a statement. He cited Gov. David A. Paterson's May directive to state agencies to afford gay couples married in jurisdictions where same-sex marriages are legal the same rights and obligations as heterosexuals.

See Law.Com for story

Spread Continues to Widen Between Fixed Rate Mortgages and Treasuries

Tuesday, November 25, 2008

Are the Fuel Savings on Smaller Cars Worth the Increased Cost of Insurance?

A 40-year-old male driver would pay an average of $1,704 to insure a 2009 Mini Cooper that gets 37 miles per gallon on the highway, according to a study by Insure.com, an online insurance broker. That same driver would pay only $1,266 -- a difference of $438 -- to insure a Toyota Sienna Minivan, which gets 23 mpg.

Cooper would exceed the additional cost of insurance. Of course, this considers only the gas savings. If you factor in the purchase price of the car, break even mileage will differ. The table below provides break even mileage at alternative gasoline prices. At the current price of about $1.75 per gallon you would have to drive 15,214 miles before breaking even.

Cooper would exceed the additional cost of insurance. Of course, this considers only the gas savings. If you factor in the purchase price of the car, break even mileage will differ. The table below provides break even mileage at alternative gasoline prices. At the current price of about $1.75 per gallon you would have to drive 15,214 miles before breaking even.Learn about Nontraded REITS

Understanding How the Credit Crisis Affects You

Consumer Driven Health Care Plans Are a Small but Growing Share of the Health Care Market

- They combine a high-deductible health plan (HDHP) with a tax-advantaged health reimbursement arrangement (HRA) or health savings account (HSA).

- The employer pays a fixed amount toward the employee's health care benefits

- Each employee controls an untaxed account that is used to pay health care bills

- Unspent money in the account accumulates for future years

- The account is accompanied by a high-deductible insurance policy that pays major expenses.

- Help with the selection of health care services with web based information

Saturday, November 22, 2008

Changes in the Relative HAI. Do they signal anything?

To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home. An index above 100 signifies that family earning the median income has more than enough income to qualify for a mortgage loan on a median-priced home, assuming a 20 percent down payment. For example, a composite HAI of 120.0 means family earning the median family income has 120% of the income necessary to qualify for a conventional loan covering 80 percent of a median-priced existing single-family home. An increase in the HAI, then, shows that this family is more able to afford the median priced home.

The calculation assumes a down payment of 20 percent of the home price and it assumes a qualifying ratio of 25 percent. That means the monthly P&I payment cannot exceed 25 percent of the median family monthly income.

There does seem to be a more interesting story waiting to be told. Both of the drops in the relative ratio were coincident with the flattening of the yield curve in 1995 and 2005.

I Thought Deflation Was a Fairy Tale

See also “U.S. price deflation on the way.”It seems unlikely that governments in China and similar emerging markets can compensate swiftly enough to boost domestic consumption. And with growing over-capacity, investment in goods production may fall even further, with serious implications for GDP. Hence the demand for commodities, which has been driven by emerging market growth, will fall sharply, and help decrease global inflation. Eventually through this channel, lower commodity prices and lower inflation will act like a huge tax cut for households, allowing interest rates to fall further and thus stabilise economic activity. Paradoxically, the faster oil prices now fall, the shorter will be the subsequent period of deflation, as further damage to the economies of industrial countries is avoided.

Oh the Misery Index

Friday, November 21, 2008

Choose Your Home Price Index

Thursday, November 20, 2008

Stocks as Lottery Tickets

Adjusted for risk, expected returns are not particularly high for firms in new industries.Our evidence is consistent with new industries having distributions of payoffs across firms that are highly skewed. In this sense, new industries are similar to lotteries. As is well known though, this can be quite consistent with a log-normal distribution and our data across firms generally are consistent with a log-normal distribution of the cumulative values across firms.

Our evidence uniformly indicates that the expected return to owners of traded stock in new industries is positive and substantial. This is consistent with a supposition that investors receive expected returns that can be interpreted as compensation for the risk they bear. We do not address whether that compensation is consistent with a model of market equilibrium at the level of individual firms.

Get Extra Credit at the Federal Reserve Bank of Atlanta

Extra Credit is an online newsletter, produced twice a year, designed to help teachers looking for timely information on economic and personal finance topics, lesson plans, and ideas for use in the classroom. Each issue also includes a calendar of upcoming teacher workshops or other events offered by the Fed or its education partners.

U.S. retail store credit card comparison table

Dynamic Maps of Bank Card and Mortgage Delinquencies in the United States

The Federal Reserve Bank of New York announce the availability of dynamic maps and data that show the rate of bank credit card delinquencies and mortgage delinquencies by county across the United States during the first quarter of 2008. These new measures complement the nonprime mortgage information released periodically since last March by providing a more comprehensive view of regional credit conditions.

Wednesday, November 19, 2008

HUD Announces New, Permanent FHA Mortgage Loan Limits

Beginning January 1, 2009, FHA will insure single-family home mortgages up to $271,050 in low cost areas and up to a maximum of $625,500 in high cost areas. The February 2008 Stimulus Package temporarily raised the FHA maximum to $729,750 through December 31, 2008. The new $625,500 maximum, however, represents a significant increase over the $362,790 limit that was in effect prior to the Stimulus Package.

Tuesday, November 18, 2008

Consumer Federation of American Reviews State Insurance Department Websites

HUD Issues New Mortgage Rules To Help Consumers Shop For Lower Cost Home Loans

HUD will require, for the first time ever, that lenders and mortgage brokers provide consumers with a standard Good Faith Estimate (GFE) that clearly discloses key loan terms and closing costs. HUD estimates its new regulation will save consumers nearly $700 at the closing table.

Last March, HUD proposed reforms to the longstanding regulatory requirements of the Real Estate Settlement Procedures Act (RESPA) by improving disclosure of the loan terms and closing costs consumers pay when they buy or refinance their home.

HUD will require the new standardized GFE and HUD-1 beginning January 1, 2010. To view these documents, click on the following links:

HUD's standard Good Faith Estimate

Friday, November 14, 2008

Measures of Economic Distress

Penn State Publications on Financial Literacy

Wednesday, November 12, 2008

Deceptive Practices in the Subprime Market

- Lenders told borrowers they would save money when consolidating their existing debts, but these "savings claims" did not take into account the loan fees and closing costs the company typically added to the consumers' loan amounts.

- Lenders did not reveal that consumers would pay only interest and would still owe the entire principal amount in a "balloon" payment at the end of the loan term.

- Lenders included single-premium credit insurance in loans, without disclosing its inclusion to consumers.

- Lenders deceived consumers about key loan terms, such as the existence of a prepayment penalty or a large balloon payment due at the end of the loan?

- Lenders falsely promised consumers low fixed payments and rates on their mortgage.

- Lenders conducted business with his clients almost entirely in Spanish, and then provided at closing loan documents in English containing the less favorable terms.

- Lenders deceptively induced consumers to purchase expensive add-on products to obtain costly refinance loans, and to pay fees to participate in a "direct deposit" program.

Monday, November 10, 2008

When is a gift card not a gift card? Answer: When the retailer goes bankrupt.

They take your money as a pledge against something in the store and then that money, in a bankruptcy, is going off to Joe the plumber, or some other secured creditor, who has priority over a gift card holder.

It's always a good year not to buy a gift card," he said. "I'm not sure what the benefit of them is anyway. They're not like a real thing the person wants, they're not as good as cash. ... Cash you can use. Uncle Sam is probably not going to file bankruptcy.If you're buying presents ... offer to wax someone's car, get them something they really need, or just hug 'em. That's what the holiday is really supposed to be.

The California Department of Consumer Affairs provides this advice.

Update on Circuit City at the WalletWhat happens if the seller of the gift certificate or gift card files

bankruptcy?

A gift certificate or gift card sold by a seller that seeks bankruptcy protection may have no value. However, the holder of the certificate or card may have a claim against the bankruptcy estate.Sellers that file "Chapter 11" (reorganization) bankruptcy intend to stay in business, so they typically will ask the bankruptcy court for permission to honor gift certificates in an effort to maintain good customer relations. If the bankruptcy court does not allow gift certificates or gift cards to be honored, or if the seller files "Chapter 7" (liquidation) bankruptcy, holders of gift certificates or gift cards are creditors in the bankruptcy case. They have relatively high priority among unsecured creditors in a Chapter 7 case, and may receive some percentage of the certificate's or card's value, but only if the bankruptcy estate has enough assets to pay claims.

For information on filing a claim, and other basic information on bankruptcy, see "Consumer Tips on Retail Store Bankruptcies," under the "Publications" tab at http://www.dca.ca.gov/, and then go to the "Consumer Publications" section, for the list of consumer publications. A recently adopted California law is intended to help gift certificate and gift card holders when the seller declares bankruptcy. It requires a seller in bankruptcy to honor gift certificates issued before the date of the bankruptcy filing.22 No court has ruled on the effectiveness of this law.

Friday, November 7, 2008

Markowitz on What Went Wrong

Now 81 and still teaching and advising funds, Mr. Markowitz has good news and bad news. The bad news is that bailouts to restore liquidity aren't addressing the real problem. The good news is that once we have the information to measure the losses of bad risk-taking, markets will recover.

TIAA-CREF Videos on Market Strategies

The following list of materials provides commentary and insights on this tumultuous period in the financial markets, as well as information about TIAA-CREF's financial strength and stability. This content is available at tiaa-cref.org and is updated regularly to reflect changing market conditions.TIAA-CREF's Chief Executive Officer Roger Ferguson on keeping the long-term view (video).

TIAA-CREF's chief investment strategist, Brett Hammond, discussing Principles & Perspectives for Weathering Volatile Times (video) and The Importance of Asset Allocation (video).

A recent interview of Roger Ferguson on the volatile markets by NPR News' All Things Considered.*

Guidance for you:

Thursday, November 6, 2008

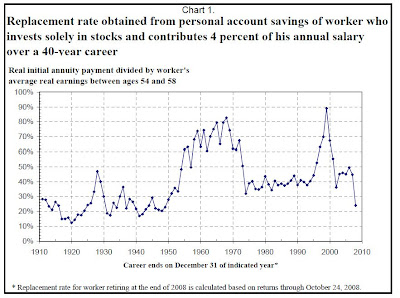

Stock Market Fluctuations and Retiree Incomes: An Update

Wednesday, November 5, 2008

FDIC Issues Final Rule on Financial Education Programs with Banking Services

FEDERAL DEPOSIT INSURANCE

CORPORATION

12 CFR Part 303

RIN 3064–AD28

Financial Education Programs That

Include the Provision

Monday, November 3, 2008

New BLS Publication on Cost for Health Benefits

The Rich Live Longer

The average age at death for men in the 2004 estate tax decedent population was 77.2, compared to 75.2 for men in the general population, while the averages for women were 82.0 and 80.4, respectively. This is consistent with research demonstrating that wealthier individuals live longer and are healthier than less wealthy individuals.

Figure C also shows the increasing longevity of both the estate tax decedent population and the general population over the past 12 years, particularly for men. In 1992, male estate tax decedents were 74.6 years old on average, about 2 ½ years younger than the average in 2004. For female estate tax decedents, the increase in longevity was slightly smaller, as female estate tax decedents in 1992 were an average of 80.2 years old, just less than 2 years younger than the average in 2004.

Sunday, November 2, 2008

Student Debt Data by Educational Institution

Interested in knowing what the typical graduate with loans at your school carries in student debt? You can find the information at the Project on Student Debt. The site also has data on the average debt and the percentage of graduates with student debt by state. The following is representative of the data you can find on each institution.

Average Debt of Graduates 2007

University of Dayton$ 20,438 Average Debt of Graduates 2006 $ 20,731 Proportion of Graduates w/debt 2007 59% Proportion of Graduates w/debt 2006 76% Full-Time Enrollment Fall 2006 6,925 2006-07 In-State Tuition $ 23,970 2006-07 % Pell Grant Recipients 11%

1.jpg)