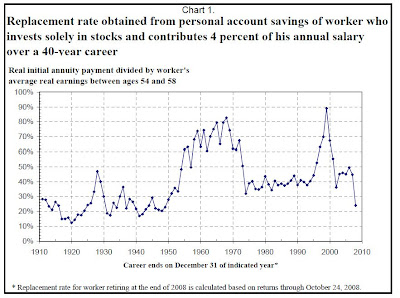

Gary Burtless has posted a paper entitled, Stock Market Fluctuations and Retiree Incomes: An Update, at the Brookings Institution's website. He states that new retirees who have invested all of their savings in the stock market will see the value of their savings fall by more than 40% in the present market decline. His basic argument is that privatization programs will divert funds from a stable source of retirement income, social security, to unstable sources such as retirement income.

Gary Burtless backcasts how much retirees could expect to accumulate in individual retirement accounts if they saved 4% of annual income over a worklife. To calculate the replacement rate, he assumes that the retirement accumulations are used to purchase a single-life annuity at age 62. The cost of the annuity is based on the return on long-term government bonds. The results are dramatically illustrated with the replacement rate falling from almost 90% at the most recent peak to less than 30 percent.

No comments:

Post a Comment