Reverse Mortgages: Product Complexity and Consumer Protection Issues Underscore Need for Improved Controls over Counseling for Borrowers, GAO-09-606 June 29, 2009

Highlights Page (PDF) Full Report (PDF, 80 pages) Recommendations (HTML)

From Summary

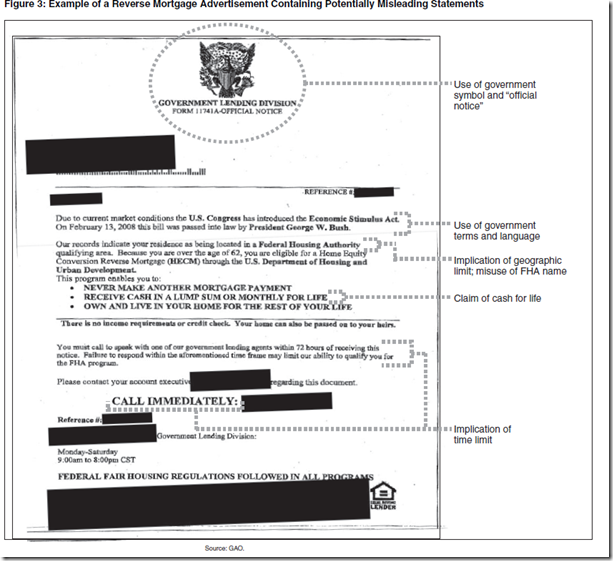

Reverse mortgages--a type of loan against the borrower's home that is available to seniors--are growing in popularity. However, concerns have emerged about the adequacy of consumer protections for this product. Most reverse mortgages are made under the Department of Housing and Urban Development's (HUD) Home Equity Conversion Mortgage (HECM) program. HUD insures the mortgages, which are made by private lenders, and oversees the agencies that provide mandatory counseling to prospective HECM borrowers. GAO was asked to examine issues and federal activities related to (1) the potential benefits and costs of HECMs to borrowers, (2) misleading HECM marketing, (3) the sale of potentially unsuitable products in conjunction with HECMs, and (4) oversight of HECM counseling providers. To address these objectives, GAO reviewed program rules; examined HECM advertisements; analyzed consumer complaint data; performed limited tests of HUD's internal controls; and interviewed HECM borrowers and agency, industry, and nonprofit officials.

The report contains examples of misleading statements made by HECM lenders.

See also Reverse Mortgages: Product Complexity and Consumer Protection Issues Underscore Need for Improved Controls over Counseling for Borrowers, by Mathew J. Scire, director, financial markets and community investment, before the Senate Special Committee on Aging, in University City, Missouri. GAO-09-812T, June 29. Highlights