Source: Congressional Research Service

401(k) Plans and Retirement Savings: Issues for Congress (PDF)

Over the past 25 years, defined contribution (DC) plans--including 401(k) plans--have become the most prevalent form of employer-sponsored retirement plan in the United States. The majority of assets held in these plans are invested in stocks and stock mutual funds, and the decline in the major stock market indices in 2008 greatly reduced the value of many families' retirement savings. The effect of stock market volatility on families' retirement savings is just one issue of concern to Congress with respect to defined contribution retirement plans.

This report describes seven major policy issues with respect to defined contribution plans: 1. Access to employer-sponsored retirement plans. In 2007, only 61% of employees in the private sector were offered a retirement plan of any kind at work. Fifty-five percent were offered a DC plan. Only 45% of workers at establishments with fewer than 100 employees were offered a retirement plan of any kind in 2007. Forty-two percent were offered a defined contribution plan.

2. Participation in employer-sponsored plans. Between 20% and 25% of workers whose employer offers a DC plan do not participate. Workers under age 35 are less likely than older workers to participate.

3. Contribution rates. On average, participants in DC plans contributed 6% of pay to the plan in 2007. The median contribution by household heads who participated in a DC plan in 2007 was $3,360. This was just 22% of the maximum allowable contribution of $15,500 in that year.

4. Investment choices. At year-end 2007, 78% of all DC plan assets were invested in stocks and stock mutual funds. This ratio varied little by age, indicating that many workers nearing retirement were heavily invested in stocks and risked substantial losses in a market downturn like that in 2008. Investment education and target date funds could help workers make better investment decisions.

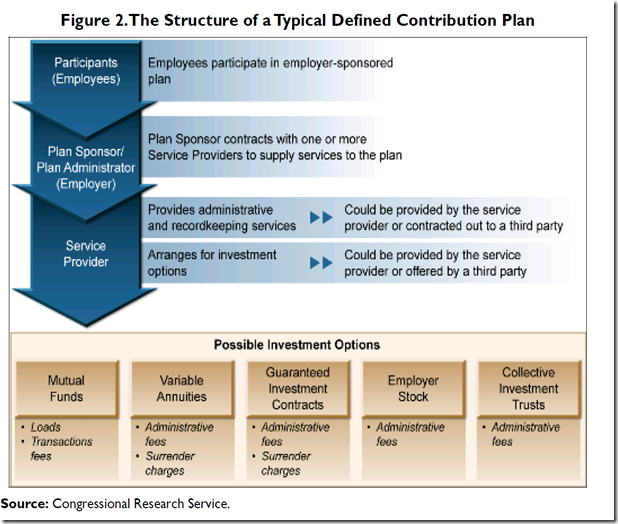

5. Fee disclosure. Retirement plans contract with service providers to provide investment management, record-keeping, and other services. There can be many service providers, each charging a fee that is ultimately paid by participants in 401(k) plans. The arrangements through which service providers are compensated can be very complicated and fees are often not clearly disclosed.

6. Leakage from retirement savings. Pre-retirement withdrawals from retirement accounts are sometimes called "leakages." Current law represents a compromise between limiting leakages from retirement accounts and allowing people to have access to their retirement funds in times of great need. In general, borrowing from a 401(k) plan poses less risk to retirement security than a withdrawal. Pre-retirement withdrawals can have adverse long-term effects on retirement income.

7. Converting retirement savings into income. Retirees face many financial risks, including living longer than they expected, investment losses, inflation, and possible large expenses for medical care and long-term care. Annuities can protect retirees from some of these risks, but few retirees purchase them. Developing polices that motivate retirees to convert assets into a reliable source of income will be a continuing challenge for Congress and other policymakers.